Iolite Vol.18

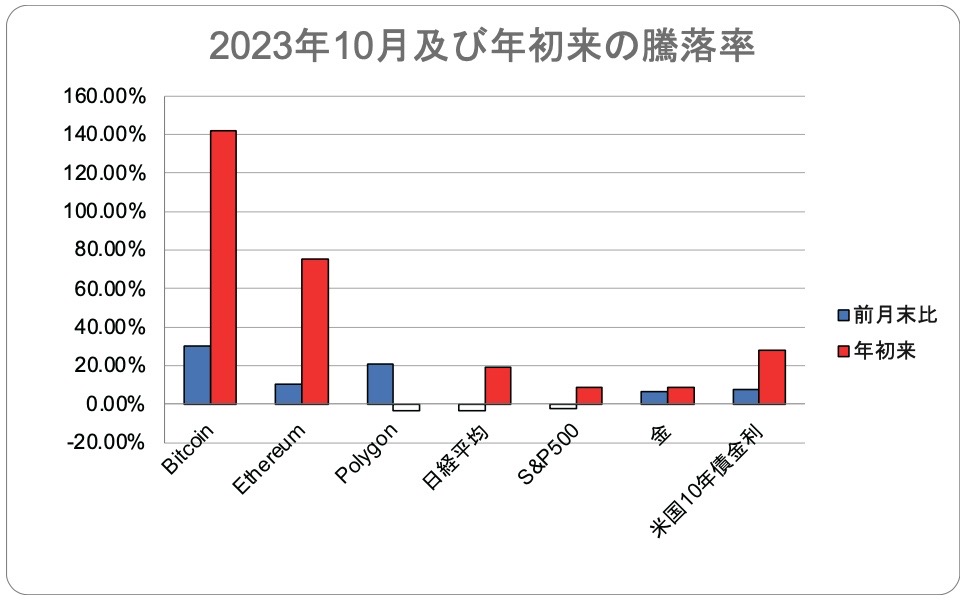

March 2026 issueReleased on 2026/01/30Interview: Iolite FACE vol.18 Takeshi Chino, Representative Director, Binance Japan PHOTO & INTERVIEW: Mai Shin Special Features: “Future Money — The Current State of Value Transfer” “Upcoming Amendments to Japan’s Crypto Asset Regulations” “The Reality of IEOs” Crypto Journey Beyond a Treasury Company: Becoming an Ethereum Evangelist — The Essence and Determination Behind HODL1’s Digital Asset Treasury (DAT) Strategy Interview with Hiroki Tahara, Representative Director, Kusim Inc. (now HODL1) Series: “Expert Perspectives on Interpreting Volatile Crypto Markets” — Kasou NISHI Series Tech and Future — Toshinao Sasaki …and more